Mortgage Blog

You Don't Have to Choose Between Your Mortgage and Your Future

Canadians’ single-minded focus on becoming mortgage-free is understandable, given our high real estate prices. But what happens when you finally succeed? You're left with a paid-off house, but often, not enough savings to enjoy it. The result is a difficult choice: either work for many more years to build a retirement nest egg, or sell your cherished home and downsize, liquidating the very asset you worked so hard to secure.

But what if there was a way to do both?

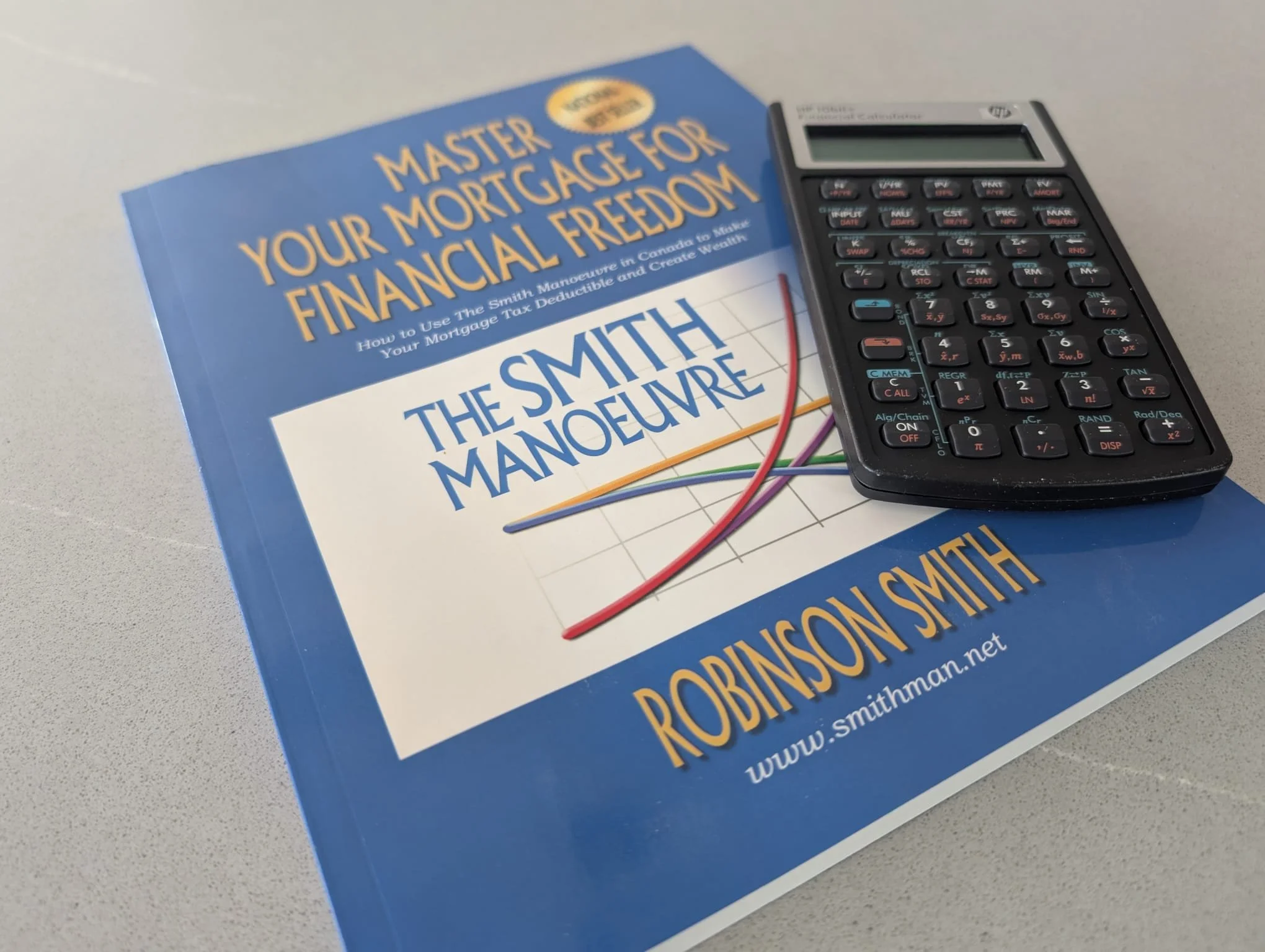

Smith Manoeuvre Simplified

The Smith Manoeuvre transforms your mortgage into a tax-deductible investment loan, enabling faster wealth creation. By leveraging a readvanceable mortgage and HELOC, you invest liberated equity in income-generating assets. The interest on these investment loans becomes tax-deductible, generating refunds that accelerate mortgage repayment. This strategy, while requiring discipline and professional guidance, effectively turns your mortgage into a wealth-building engine.

Empowering Your Retirement: Practical Uses for a Reverse Mortgage

Unlock retirement potential! Read about practical ways Canadian seniors are using reverse mortgages to boost income, downsize easily, fund home improvements, and consolidate debt. See real-life examples.

What is The Best Way to Improve Your Credit Score?

Ready to unlock better mortgage rates and more? Our latest blog breaks down what your credit score is and provides 5 simple yet powerful steps you can take today to improve it! We also bust some common credit score myths. Building good credit takes discipline, but it opens doors for your future, even if you're not buying a home right now. Click the link below to take control of your credit!

Enjoy Their Success With Them; Your Home Can Provide a Living Inheritance

Want to help your kids now AND see the impact? A "living inheritance" could be the answer. This blog explores how using your home equity with a reverse mortgage can allow you to gift funds to loved ones today, helping them with big life steps like buying a home.

The Mortgage Process: What to Expect at Every Stage

The mortgage process can seem daunting, but with a mortgage broker, you’ll be guided through it one step at a time. In this blog, we walk you through each step with tips to be even more successful.

Are Reverse Mortgages a Good Idea?

Reverse mortgages earned a bad reputation as predatory for many years but have had a major re-brand in the past 10 years or so. Learn how Canadian regulations transformed them, who qualifies, and if it's right for your retirement.

How Does a Reverse Mortgage Work?

You have worked hard to own your home and retire comfortably. If you’re not as comfortable as you were hoping, of if you want to do something extra that your budget can’t accommodate, a Reverse Mortgage might be right for you.

How much does it cost to use a mortgage broker?

Confused about mortgage broker fees vs. bank costs? This guide breaks down what you can expect to pay (and what you won't!) when using a broker, plus how it compares to going direct to your bank. Get clear answers and make the best choice for your mortgage.

From Rejected to Approved: A Mortgage Comeback Story

Got turned down for a mortgage? Don't give up! This real-life case study shows how a mortgage broker can help you get approved, even when your bank says no. Learn why working with a broker is key to finding the right mortgage for you.

Bank vs. Mortgage Broker

Why use a mortgage broker in Canada? Get a better mortgage with expert advice, more options, and a stress-free experience. Learn how it works (and why it's often free!).

Schedule a Call Today

Tell me about what you’re looking to do and I can answer any (and I mean any) questions you have. By the end of the call, I’ll be able to give you a good idea about your options.